CEO Data Breaches Pose Significant Risks

In a shocking incident that underscores the growing sophistication of cybercrime, criminals in Hong Kong have successfully used deepfake AI technology to trick an employee into transferring a substantial sum of money to them. This case highlights the increasing dangers of CEO fraud, where data breaches can significantly amplify the risks.

Details of the Incident

In this recent fraud case, criminals employed advanced deepfake AI to impersonate a high-ranking executive of a Hong Kong-based company. By creating a highly realistic audio and visual representation of the CEO, the criminals managed to deceive an employee into believing that the request for a funds transfer was legitimate. Trusting the authenticity of the deepfake, the employee proceeded to transfer a significant amount of money to the criminals’ account.

The Role of Deepfake Technology

Deepfake technology uses artificial intelligence to create hyper-realistic audio, video, and images that can convincingly mimic real individuals. In this instance, the technology was used to fabricate a seemingly authentic interaction with the company’s CEO, exploiting the employee’s trust and the perceived legitimacy of the request.

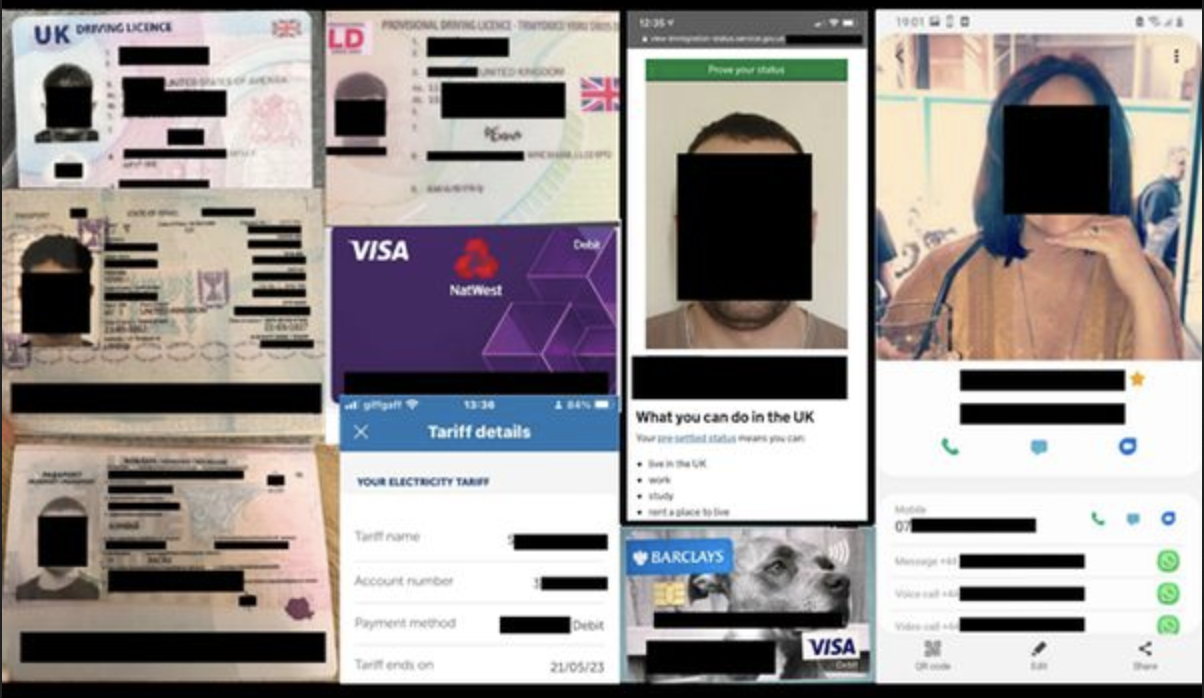

The Risks of CEO Data Breaches

This case underscores the severe risks associated with CEO data breaches. When cybercriminals gain access to sensitive information about company executives, such as personal details, communication styles, and patterns, they can create highly convincing deepfakes. The recent Clarity.fm data breach is a good example of how digital forgeries can be used to orchestrate CEO fraud, manipulating employees into executing unauthorized financial transactions.

Implications for Businesses

The implications of such fraud are far-reaching:

- Financial Loss: The immediate consequence is the direct financial loss incurred by the company due to unauthorized transfers.

- Erosion of Trust: Incidents like these can erode trust within the organization, making employees more skeptical of legitimate communications from their superiors.

- Reputation Damage: The company’s reputation can suffer, impacting client relationships and business opportunities.

- Increased Security Costs: Businesses may need to invest significantly in enhanced security measures to prevent future incidents.

Preventative Measures

To protect against such sophisticated fraud attempts, businesses must adopt a multi-faceted approach:

- Advanced Security Protocols: Implement robust cybersecurity measures, including encryption and secure authentication methods.

- Employee Training: Regularly train employees to recognize and respond to potential phishing and fraud attempts. Emphasize the importance of verifying unusual requests, even if they appear to come from high-ranking executives.

- Verification Processes: Establish strict procedures for confirming the authenticity of financial transactions, including multi-factor authentication and requiring secondary approvals.

- Monitoring and Response: Continuously monitor for suspicious activity and have a clear incident response plan to quickly address any breaches or fraudulent activities.

The recent deepfake AI fraud in Hong Kong serves as a stark reminder of the evolving landscape of cyber threats. As technology advances, so too do the methods employed by cybercriminals. Companies must remain vigilant, investing in robust security measures and fostering a culture of skepticism and verification to protect against such sophisticated fraud attempts. CEO data breaches, in particular, pose a significant risk, as the information obtained can be used to create convincing deepfakes that exploit trust and authority within organizations.

Our team of writers, armed with a healthy dose of caffeine and an overflowing imagination covers wacky and weird news. From politics to pop culture, from bizarre headlines to analysis, we take a sideways glance at the world’s happenings, delivering news in a way that’s informative, entertaining, and occasionally eyebrow-raising.