Invoice Fraud: A Growing Threat and How Companies Can Defend Against It

Invoice fraud has emerged as a significant threat in the digital age, where cyber criminals exploit vulnerabilities to manipulate or fabricate invoices, resulting in unauthorized financial transactions. The consequences can be severe, impacting both companies and their customers. This article explores the nature of invoice fraud and provides actionable steps companies can take to protect themselves.

What is Invoice Fraud?

Invoice fraud involves deceptive tactics where criminals trick businesses into paying fraudulent invoices. This can occur through various methods:

- Phishing Emails:

- Attackers send emails with fake invoices that appear to come from legitimate sources. These emails prompt businesses to make payments to fraudulent accounts.

- Creation of Fake Invoices:

- Fraudsters create invoices that closely resemble those from legitimate vendors, requesting payment for goods or services that were never provided.

- Tampering with Genuine Invoices:

- Authentic invoices are intercepted and altered to change payment details, redirecting funds to the fraudster’s account.

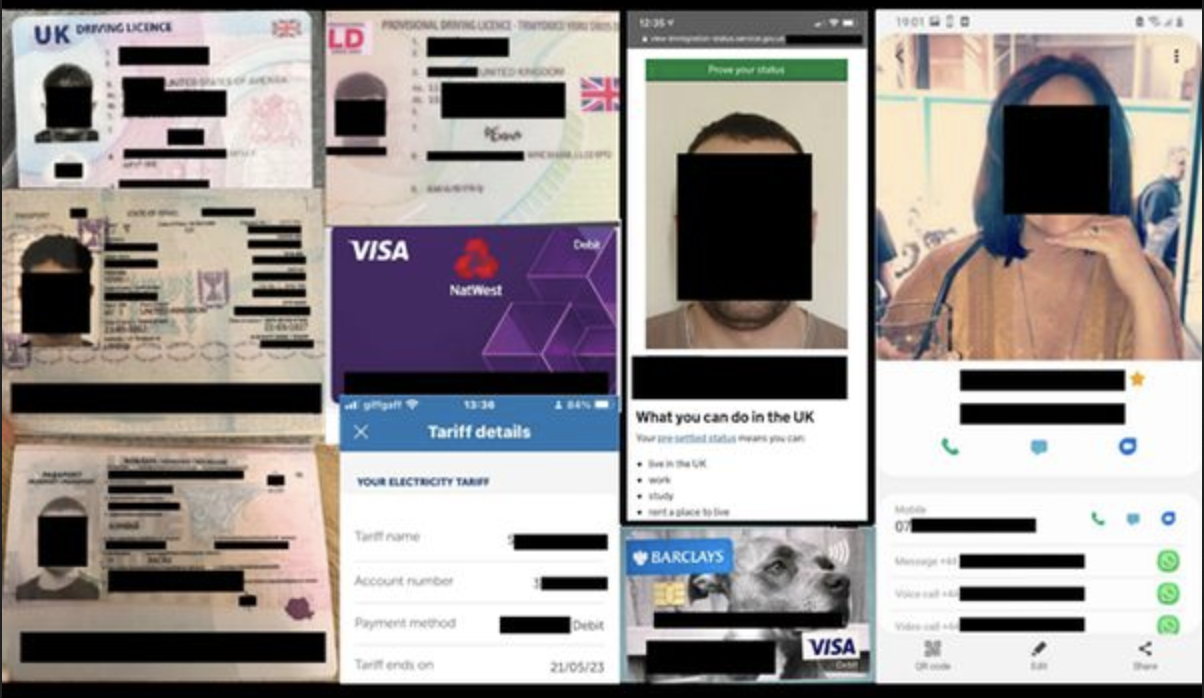

- Impersonation of Vendors:

- Using information obtained through data breaches, criminals pose as real vendors, sending fraudulent invoices that might evade normal verification processes.

Consequences of Invoice Fraud

The impact of invoice fraud can be extensive, including direct financial losses, operational disruptions, and damage to business relationships and reputation. Additionally, companies may face legal and regulatory challenges if they fail to adequately protect sensitive financial information.

How Companies Can Protect Themselves

To defend against invoice fraud, companies must implement comprehensive security measures and best practices. Here are key strategies to safeguard your business:

- Enhanced Access Controls:

- Secure all financial systems and databases with strong passwords and restrict access to authorized personnel only. Implement multi-factor authentication (MFA) for added security.

- Regular Security Audits:

- Conduct frequent security audits and vulnerability assessments to identify and mitigate potential weaknesses in your systems. Use automated monitoring tools to detect unusual activities and alert administrators to potential breaches in real-time.

- Data Encryption:

- Encrypt sensitive data during transmission and at rest to prevent unauthorized access and ensure data remains secure even if intercepted.

- Employee Training and Awareness:

- Offer regular training sessions to educate employees on the risks of invoice fraud and best practices for data security. Teach staff how to recognize phishing attempts and other common fraud tactics.

- Rigorous Invoice Verification:

- Implement thorough verification processes for all invoices received. Cross-check invoice details with purchase orders and directly contact vendors to confirm authenticity. Employ automated tools to flag discrepancies or suspicious invoices for further scrutiny.

- Vendor Management:

- Perform due diligence on all vendors to ensure they adhere to strict data security standards. Regularly review their security practices and require them to implement robust security measures.

- Segregation of Duties:

- Separate responsibilities within financial processes to ensure no single individual has control over all aspects of invoice processing and payment authorization, reducing the risk of internal fraud.

- Secure Payment Methods:

- Use secure and traceable payment methods, such as electronic funds transfers (EFT) or automated clearing house (ACH) payments, to enhance transaction security.

Invoice fraud represents a significant risk in today’s business environment. By understanding the tactics used by fraudsters and implementing robust security measures, companies can effectively reduce their vulnerability to such schemes. Regular employee training, stringent verification processes, strong access controls, and continuous security audits are essential components of a comprehensive defense strategy. One recent example is the recent data breach involving Patties Foods Limited, a prominent Australian food manufacturer. Two unprotected databases were exposed: one logging server containing 496,296 records with system errors, warnings, search queries, and emails; and a cloud storage database holding 25,800 invoices and distribution records in .pdf and .xls formats. The exposed data included sensitive internal, customer, and vendor information, raising serious concerns about invoice fraud and cyber crime. The breach underscores the critical need for robust data security measures to protect against such vulnerabilities.

By staying vigilant and proactive, businesses can protect their financial transactions and sensitive data from the ever-evolving threats posed by cyber criminals.

Our team of writers, armed with a healthy dose of caffeine and an overflowing imagination covers wacky and weird news. From politics to pop culture, from bizarre headlines to analysis, we take a sideways glance at the world’s happenings, delivering news in a way that’s informative, entertaining, and occasionally eyebrow-raising.